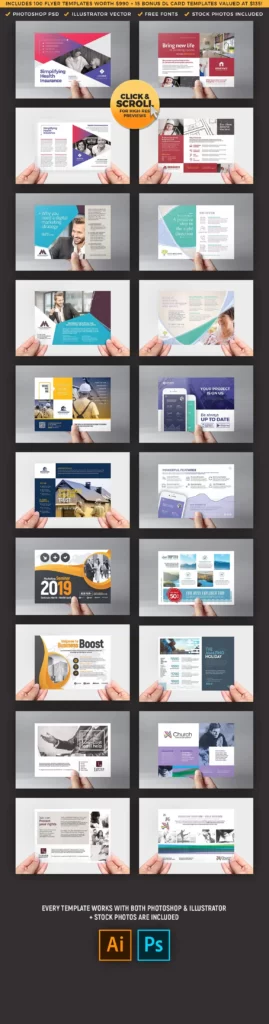

HUGE 100+ Flyer Templates Bundle PSD Files

Looking for flyer templates PSD Files? Look no further!

This massive bundle of over 100+ double-sided flyer templates PSD Files includes everything you need to create professional flyers and Poster PSD, fast and easy to use!

You’ve undoubtedly already seen a flyer & poster from this bundle in PSD Files that you’d love to use Photoshop and easy to edit and change your requirement, so why not grab the whole lot and keep them in your design using all Photoshop toolbox?

Save yourself more time and money on future projects by grabbing our discount Flyer & Poster PSD bundle today:

Key benefits of these templates PSD:

- Works with BOTH Photoshop & Illustrator File Format

- Each template comes in PSD & Vector Ai Files

- Very easy to customize & CMYK print-ready File format

- Stock photos included free in every template poster and flyer

- Both front and back page designs (meaning a total of 200+ unique designs in PSD File Format)

- 100% vector-based design and file

- Rockstar Customer Support 24\7